In 2025, the net lease market continues to evolve as demand for passive, stable income accelerates across the United States. Investors—especially those completing 1031 exchanges—are prioritizing assets with dependable tenants, predictable cash flow, and minimal landlord obligations. This explains why NNN Properties remain one of the most sought-after real estate categories nationwide.

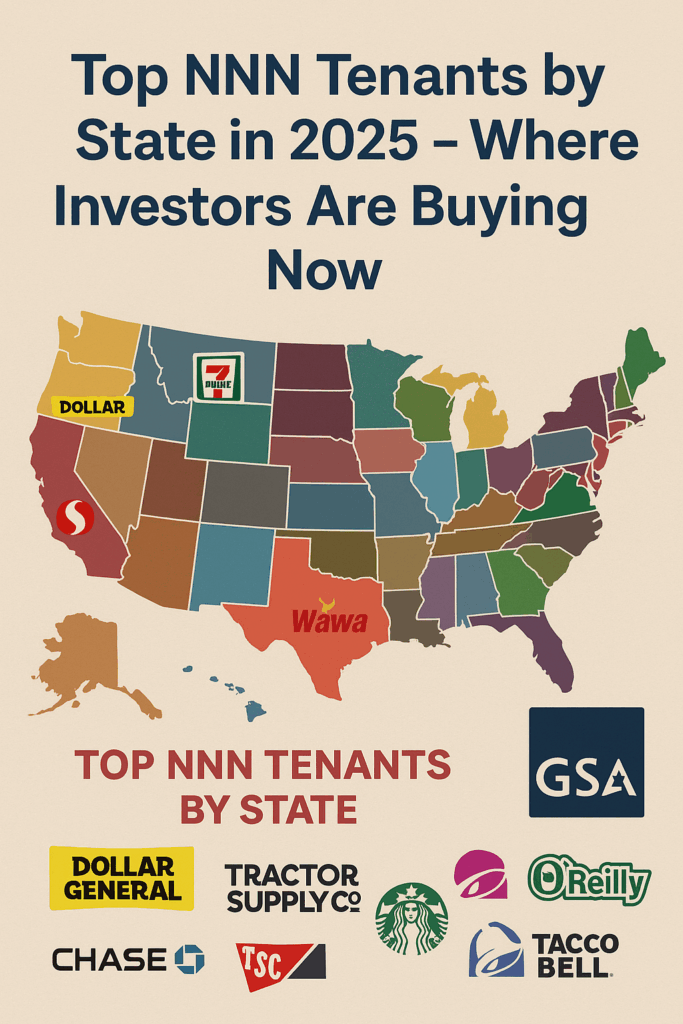

But what types of tenants are investors chasing this year? More importantly, which states are seeing the highest concentration of activity? To answer this, we take an insightful look at the top NNN tenants by state in 2025, highlight shifting cap rate trends, and examine why certain markets are outperforming others.

Whether you’re a seasoned investor or exploring your first NNN Investment, this breakdown offers clear guidance on where capital is flowing—and why.

Why Tenant Type Matters in the NNN Market

Triple net properties are attractive because tenants are responsible for taxes, insurance, and maintenance, reducing landlord involvement to near zero. However, not all tenants are equal—credit strength, business model resilience, lease structure, and regional dominance significantly impact long-term performance.

In 2025, investors are prioritizing tenants with:

-

Essential goods or service-based models

-

Corporate-guaranteed, long-term leases

-

Strong recession and e-commerce resistance

-

State or national brand recognition

This is where the analysis of state-by-state tenant demand becomes essential.

Top NNN Tenants by State in 2025 (Market Highlights)

Based on nationwide closing trends, broker reports, and investor demand patterns

1. Texas – Dollar General & 7-Eleven Lead the Pack

Texas continues to dominate the NNN landscape due to its population growth and business-friendly environment. Dollar General, 7-Eleven, and O’Reilly Auto Parts remain the most traded assets.

Why investors love them:

-

Reliable rural and suburban performance

-

High store counts and strong expansion plans

-

Attractive state cap rates compared to coastal markets

For buyers using a 1031 exchange, Texas remains an ideal hunting ground for stable national brands.

2. Florida – Wawa and Walgreens Remain Investor Favorites

With steady net migration and a booming retail sector, Florida NNN properties stay in high demand. Wawa’s expansion and Walgreens’ credit strength continue to attract high-volume investors.

Florida’s appeal:

-

High visitor traffic

-

Dense suburban and coastal populations

-

Long-term, corporately guaranteed leases

Cap rates here trend slightly lower due to intense competition—but stability offsets yield compression.

3. North Carolina – Tractor Supply and AutoZone Drive Rural & Suburban Demand

North Carolina’s mix of rural and metro markets creates ideal territory for Tractor Supply, AutoZone, and Dollar General.

Why investors are buying:

-

Rural retail resilience

-

Strong customer loyalty and repeat business

-

Expanding distribution networks

These tenants align well with national retail trends and offer predictable NNN returns.

4. California – Safeway, Chase Bank, and GSA Anchoring Stability

California’s NNN market behaves differently due to dense populations and strict development regulations.

Top 2025 tenants include:

-

Safeway (essential grocery)

-

Chase Bank (long-term corner locations)

-

GSA, the federal government—arguably the most secure tenant in America

Despite lower cap rates, California stays attractive due to exceptionally low vacancy risk.

5. Midwest States (Ohio, Michigan, Indiana) – Auto Parts & Quick-Service Restaurants Dominate

The Midwest markets continue to attract investors seeking balance between cap rate and tenant quality.

Top tenants in 2025 include:

These states also show strong liquidity for NNN Properties priced between $1M and $3M, ideal for smaller 1031 buyers.

Why 2025 Is a Pivotal Year for State-by-State NNN Investing

Several macro trends are shaping investor behavior:

1. Cap Rate Stability Across Most States

While interest rates remain a concern, NNN cap rates have leveled in many states. In some regions, such as the Southeast and Midwest, state cap rates are slightly higher, creating better yield opportunities without sacrificing tenant strength.

2. Essential Retail Is Still King

Tenants selling necessities—fuel, food, auto parts, healthcare—continue to outperform non-essential categories.

3. Investors Are Prioritizing Long-Term Leases

20-year and 15-year corporately guaranteed leases are the most traded in 2025, providing predictable income and reduced risk during market fluctuations.

4. Portfolio Diversification Across States

Many investors now spread their 1031 funds across multiple states to balance:

-

Cap rates

-

Tax environments

-

Tenant concentration risks

Triplenet Investment Group, along with other NNN advisory firms, notes that multi-state acquisitions are rising sharply as investors pursue both yield and safety.

Which States Offer the Best Opportunities in 2025?

Final Thoughts: Where Investors Are Buying Now

Best for Higher Cap Rates

Perfect for investors seeking strong returns while maintaining tenant stability.

Best for Long-Term Stability

-

Virginia (GSA & federal tenants)

These states offer a strong blend of creditworthy tenants and prime real estate.

Best for Growth Markets

Population expansion fuels long-term retail demand and lower vacancy risk.

In 2025, investors are not only choosing properties—they’re choosing states, tenant mixes, and long-term strategies that align with income goals and risk tolerance.

Across the board, demand is strong for:

-

geographically diverse portfolios,

-

stable NNN Properties, and

-

high-credit essential retailers.

For those pursuing 1031 exchanges, the data is clear: state-by-state tenant performance is more important than ever. By evaluating where demand is strongest—and why—investors can make informed, strategic decisions that deliver stable, passive income for years to come.

Whether you’re acquiring your first net lease asset or adding to an established portfolio, understanding where the market is moving in 2025 is the key to successful, long-term NNN Investment planning.