Delayed 1031 Exchange

Delayed 1031 Exchange

Three Types of 1031 Delayed Exchange

Delayed 1031 exchange process

The Delayed exchange allows the involved businesses or individuals to relinquish the initial property and buy the replacement property on different dates. Hence, the exchange needs not to take place on the same date, unlike the simultaneous 1031 exchange. It is also often referred to as “Starker Exchange”, “Deferred Exchange”, or “Like Kind Exchange”. The maximum permissible 1031 exchange timeline set by the Code and Regulations to complete the property transfer formalities is 180 days. However, it is important to identify the replacement property 45 days of the transfer of the relinquished property.

The delayed 1031 exchange process is a preferred alternative for traders who find it hard to perform 1031 exchange in real estate under simultaneous exchange, the reason being an extended period for transaction. It requires the interference of a third party that could help in all the involved aspects of property exchange including the sale and purchase of the property under consideration. In addition, the exchange firms also hold the proceeds from the relinquished property to use it later for buying the replacement property.

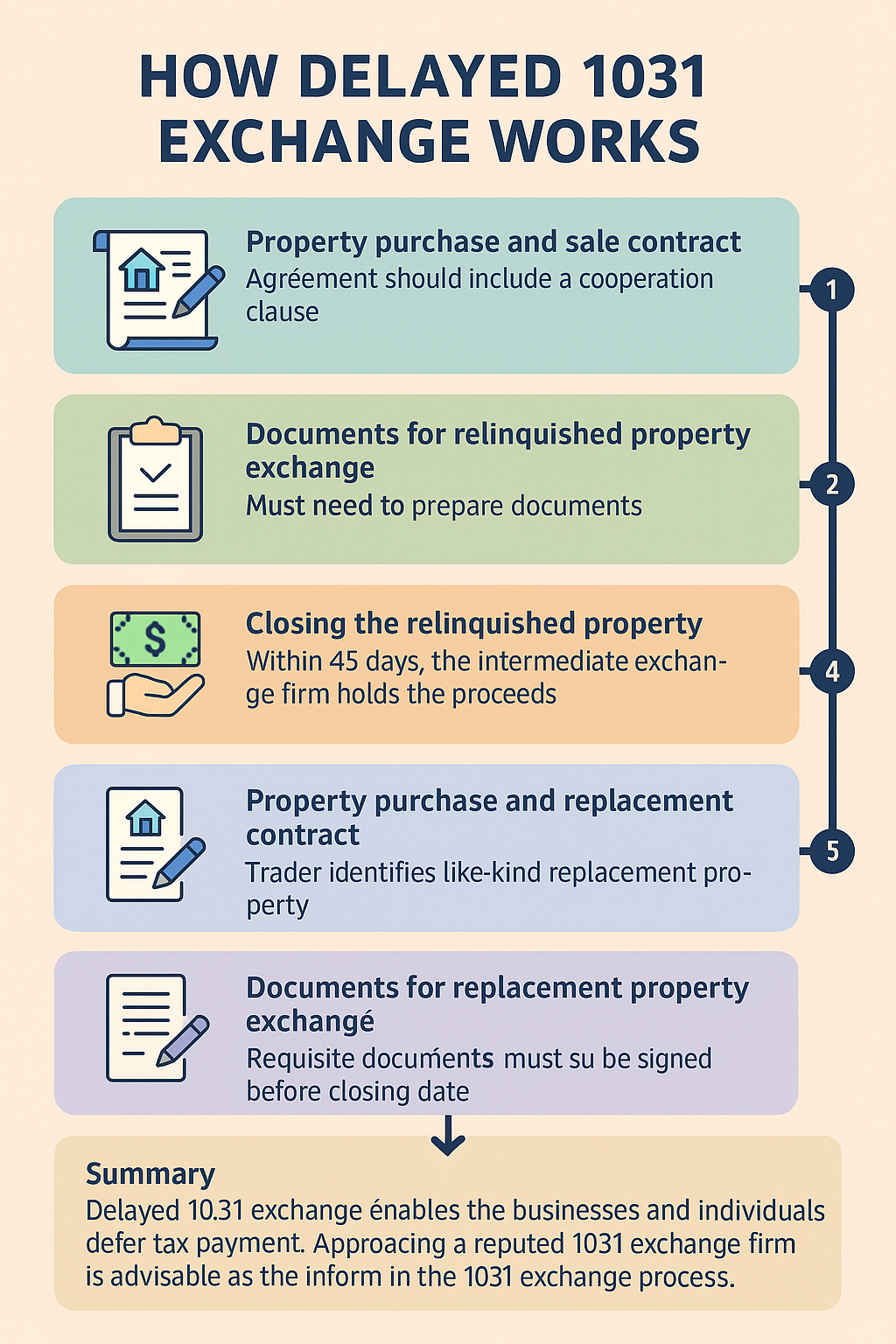

How delayed 1031 delayed exchange work?

The steps related to 1031 exchange requirements are as below:

Property purchase and sale contract: The agreement should include a “cooperation clause” that asks the buyer to cooperate in the structuring of the transaction as a delayed or tax-deferred exchange. The third party facilitator plays an important part in converting this “sale” transaction into a 1031 exchange, using specific documents.

Documents for relinquished property exchange: Once done with the contract, the traders need to initiate the 1031 exchange process with the help of a 1031 exchange real estate or a 1031 exchange commercial real estate provider, as the case may be. The approached agency could assist better in preparing various important documents related to 1031 exchange of properties.

Closing the relinquished property: After the completion of documentation work, the relinquished property is conveyed to the buyer.

Relinquished property proceeds and forms: The intermediate exchange firm holds the proceeds from the relinquished property exchange and asks the seller to identify potential replacement properties within 45 days.

Property purchase and replacement contract: The trader identifies like-kind replacement property and signs a purchase contract with its owner. The contract should contain a cooperation clause

Documents for replacement property exchange: The 1031 exchange firm then prepares the requisite documents to fulfill the 1031 exchange requirements, which must be signed before the closing date.

Closing the replacement property: The closing should take place within the allowed 1031 exchange timeline of 180 days.

Summary: The delayed 1031 exchange of properties enables the businesses and individuals defer tax payment. Approaching a reputed 1031 exchange firm is advisable as they inform you of various delayed exchange types, suggest the preferred one, and assist in the 1031 exchange process.

At Triple Net Investment Group we can assist you in locating a like-kind property for a 1031 exchange and ensure a smooth and successful transaction.

Three Types of Delayed 1031 exchange

As notified in the website, the traders can identify more than one potential replacement property in delayed exchange under any of the following 1031 exchange rules:

- Delayed exchange under the Three-Property Rule: This allows identifying three properties irrespective of their current market values.

- Delayed exchange under the 200% Rule: This is one of the three 1031 exchange rules and allows identifying as many properties as possible on the condition that their combined fair market value remains less than double the value of the relinquished property.

- Delayed exchange under the 95% Rule: This allows the identification of any number of potential replacement properties irrespective of their combined fair market value, on the condition that the trader acquires 95 percent or more of the aggregate value of the relinquished property.

Simultaneous or Concurrent 1031 Exchange Definition

Sometimes, you could close up your current sale and purchase dealings simultaneously or concurrently. The simultaneous or concurrent 1031 exchange agreement is regarded as the most fundamental of 1031 exchange set ups. A simultaneous or concurrent 1031 exchange takes place whenever a number of relinquished properties are substituted or exchanged simultaneously for just one or more replacement properties. Both the relinquished property and the replacement property contracts; close up on exactly the same day in a concurrent or simultaneous 1031 exchange.

The simultaneous exchange is the most well-known technique of accomplishing an IRC 1031 tax deferred exchange. Listed below are basically three methods or rules for doing a 1031 simultaneous exchange:

Swap or Two-Party Deal

In this deal, a pair of parties exchange (“swap”) deeds amongst each other.

- Benefits: It is not necessary for a Qualified Intermediary.

- Drawbacks: Overwhelming to come across one more party who desires to exchange for your property. The other party should desire what you have at precisely the same moment you wish to obtain their property. Equity and debt must coordinate on both of these properties to evade one party realizing some kind of “boot”.

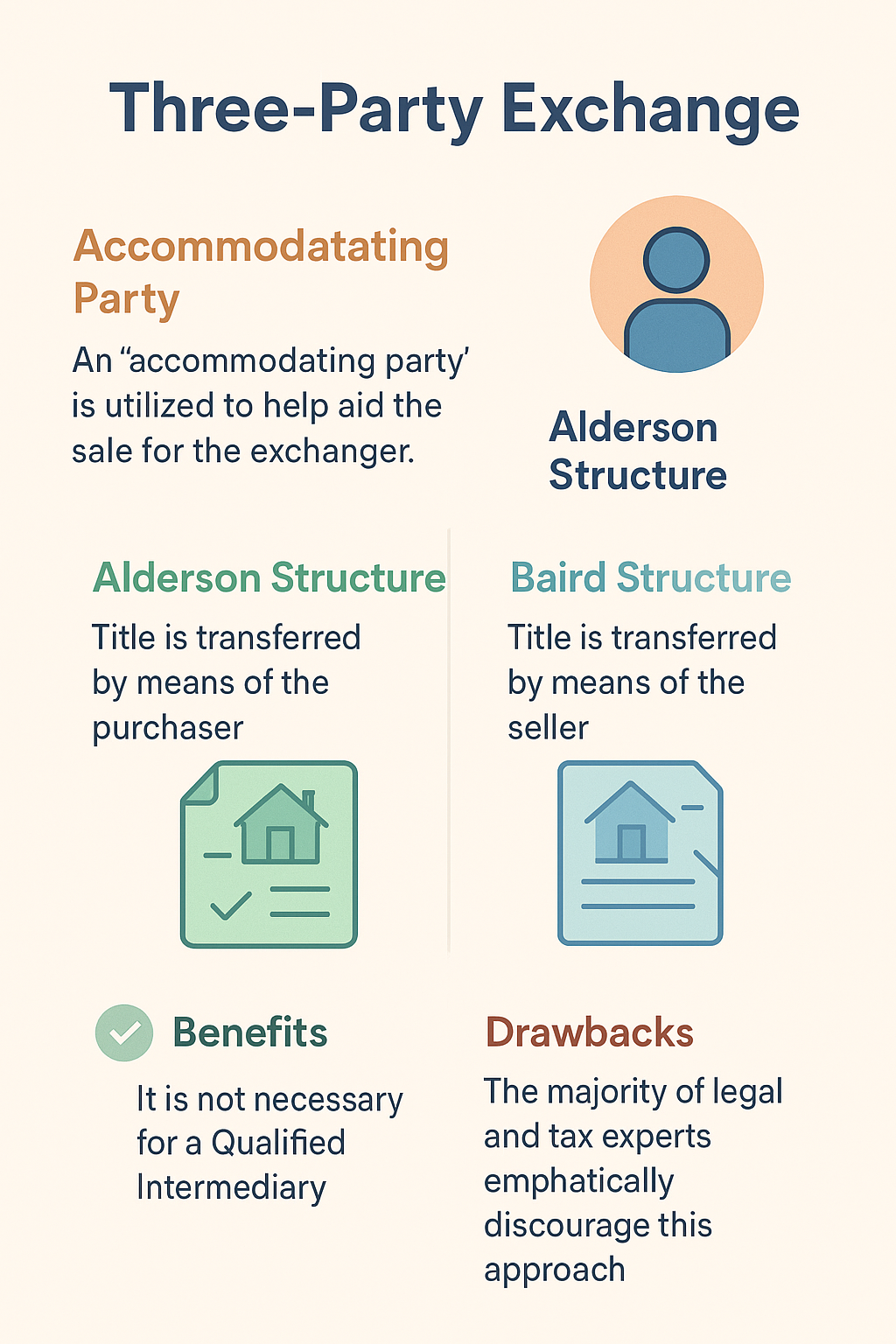

Three-Party Exchange

An “accommodating party” is utilized to help aid the sale for the Exchanger. In the Alderson structure,

Title is transferred by means of the Purchaser. In the Baird structure, title is transferred by means of

the Seller.

Benefits: It is not necessary for a Qualified Intermediary.

Drawbacks: The majority of legal as well as tax experts emphatically dissuades their customers from using this approach. One of the major reasons, this strategy is not recommended is the fact that the “accommodating party” pretty much gets title to an investment property which they know practically nothing about. For the reason that this party is on the sequence of title, they really are subjected to any problems connected with that property, which includes the possibility to be involved with environmental concerns. Furthermore, there exists minimal paperwork apart from documenting of the deeds to support, that an exchange had already been organized.

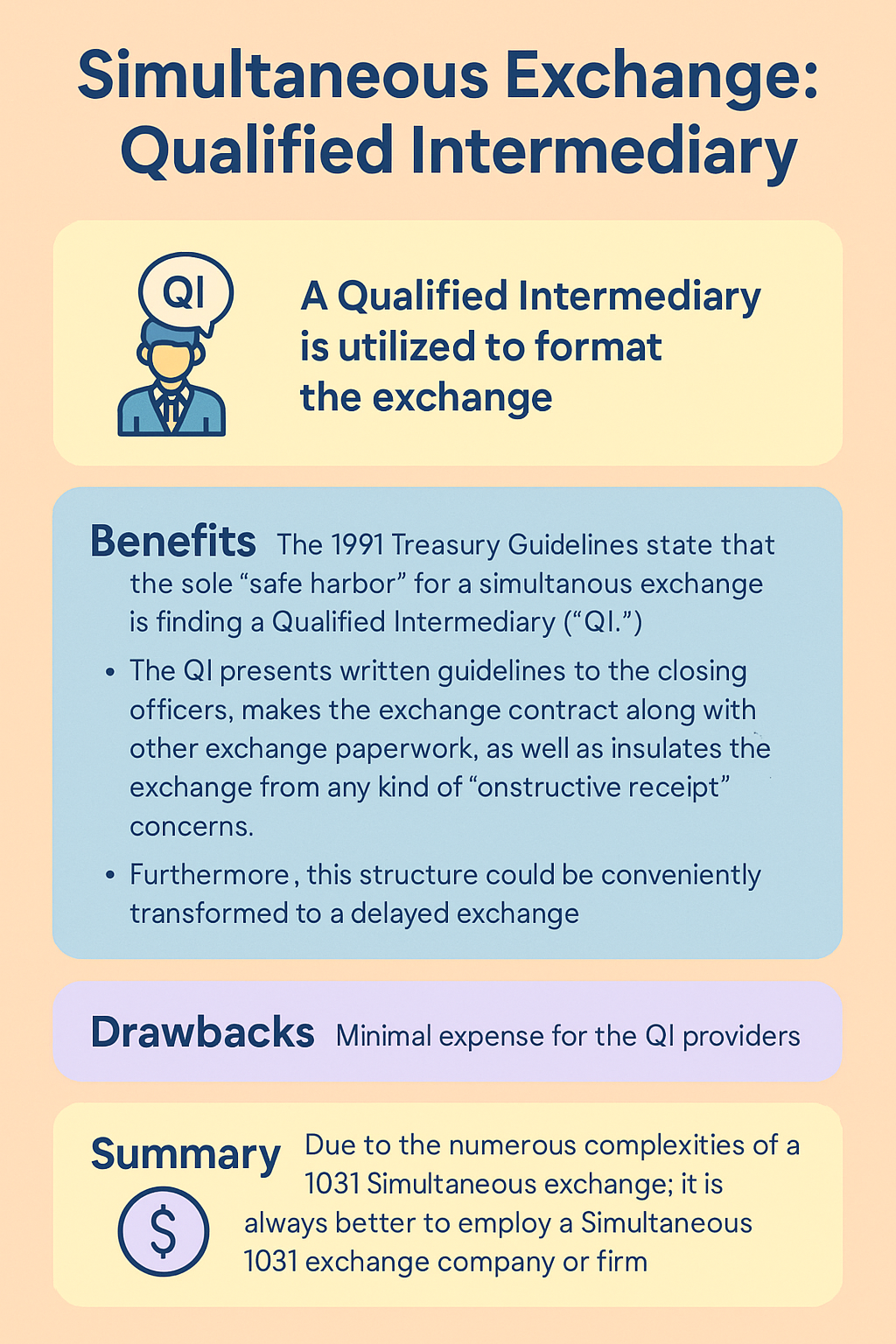

Simultaneous Exchange with a QI

A Qualified Intermediary is utilized to format the exchange.

Benefits: The 1991 Treasury Guidelines state that the sole “safe harbor” for a simultaneous exchange is finding a Qualified Intermediary (“QI.”). The QI presents written guidelines to the closing officers, makes the exchange contract along with other exchange paperwork, as well as insulates the exchange from any kind of “constructive receipt” concerns. Furthermore, this structure could be conveniently transformed to a delayed exchange and then, the time pressure of aiming to close up the complete deal can be removed simultaneously.

Drawbacks: Minimal expense for the QI providers

Even though properties close up on the exactly the same day, any one of these three strategies needs to be utilized to execute a legitimate exchange.

Due to the numerous complexities of a 1031 Simultaneous exchange; it is always better to employ a Simultaneous 1031 exchange company or firm with significant experience in dealing with 1031 Exchange transactions before venturing into an exchange.

At Triple Net Investment Group we can assist you in locating a like-kind property for a 1031 exchange and ensure a smooth and successful transaction.