Reverse 1031 Exchange FAQ

Reverse 1031 Exchange FAQ

Reverse 1031 Exchange - Frequently Asked Questions

What is a reverse 1031 exchange?

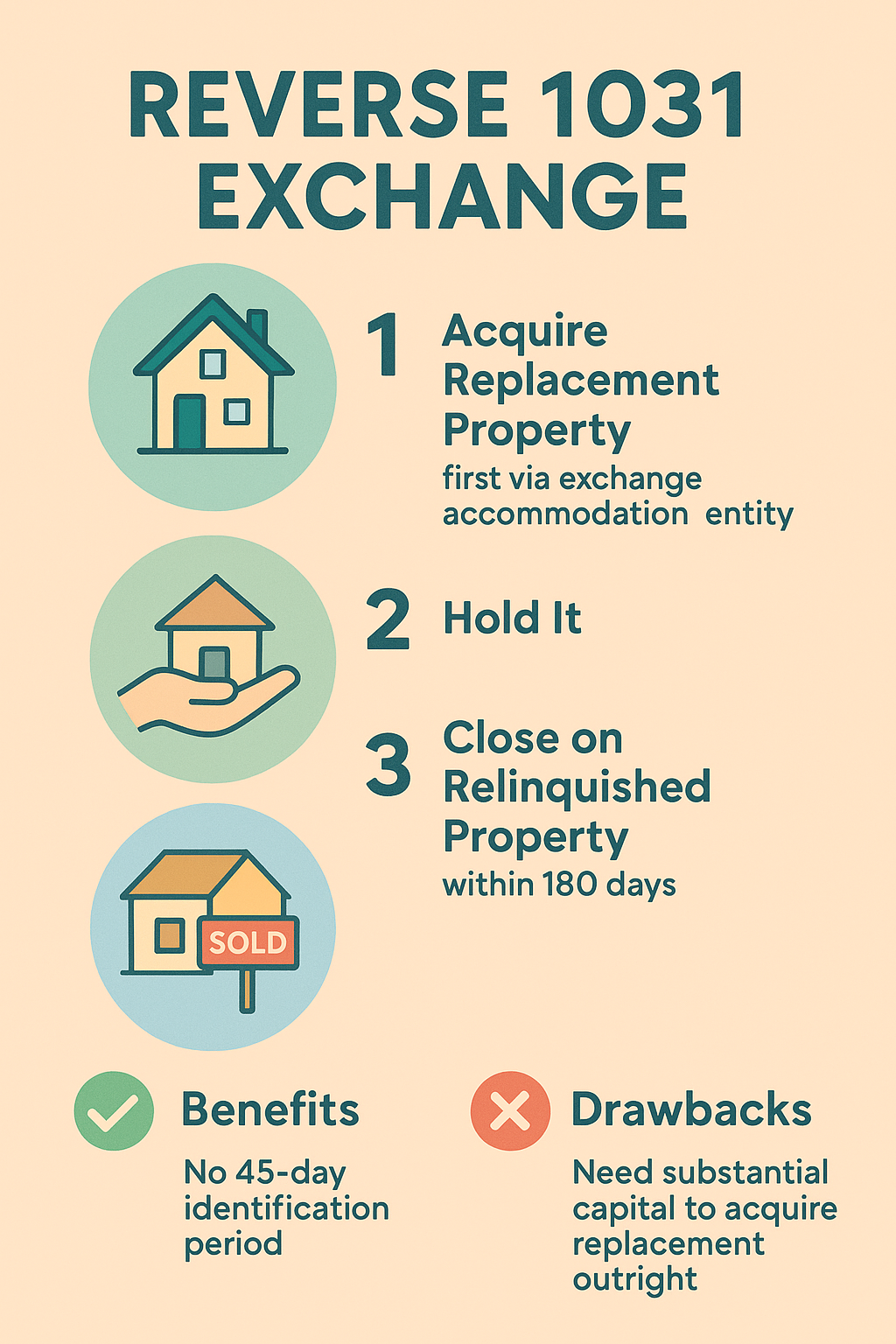

Under IRC code section 1031 (IRS) of the United States, a Reverse Exchange of properties is a kind of property exchange that may defer the capital taxes and gains due upon the sale of a personal property by purchasing the replacement property before the relinquished property is sold.

reverse-1031-exchange-faq.html