1031-Exchange Investment Properties

Comparing 1033 and 1031 Exchange

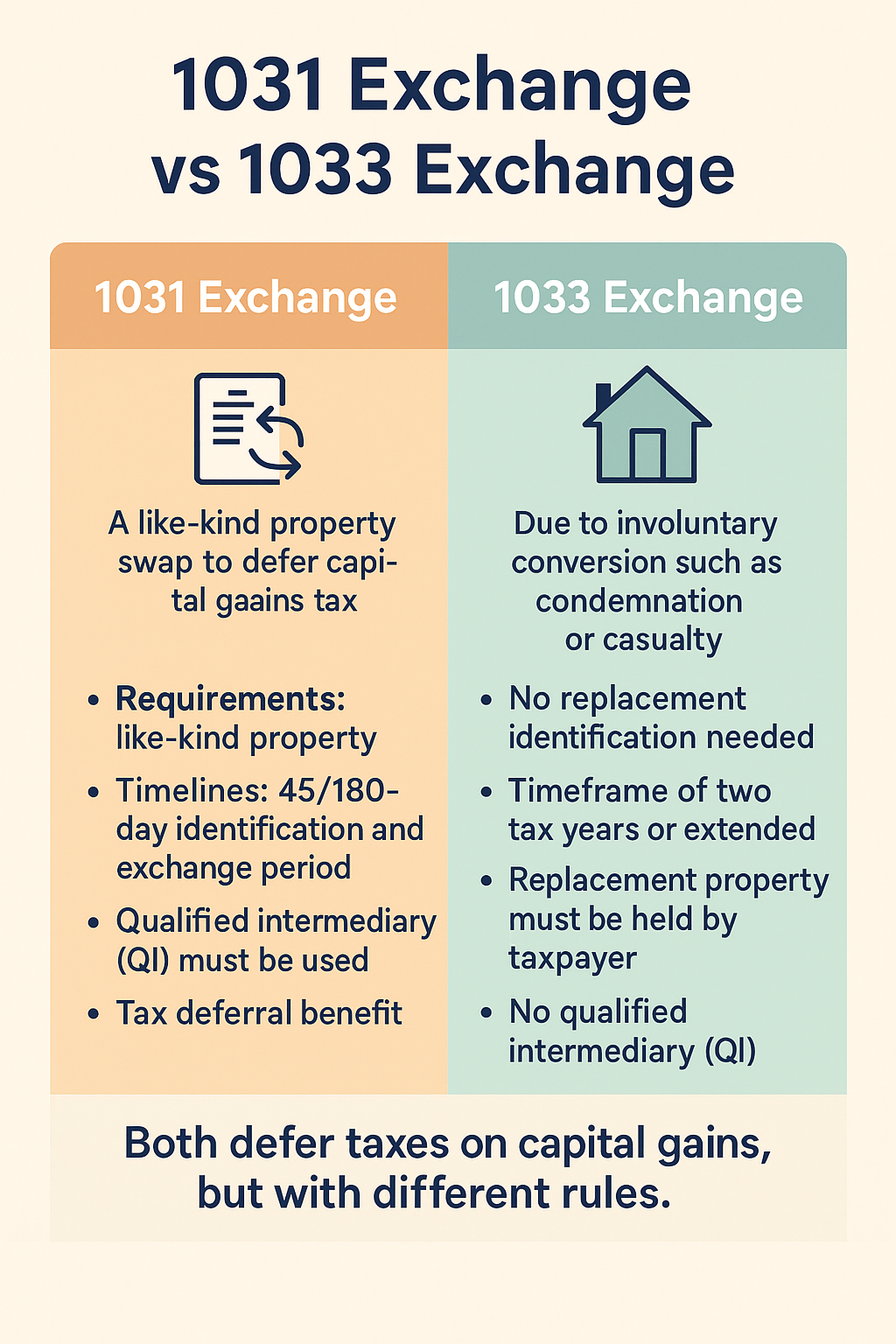

1033 Exchange is involuntary sale of investment property through eminent domain ( government taking the property for its own use ), destruction or theft and tax payer receives money from insurance company or government.

1031 Exchange is voluntary sale of investment property for purpose of buying another investment property equal or higher in price.

1033 Exchange does not require the use of QI, qualified intermediary

1031 Exchange requires the funds to be placed with QI, qualified intermediary

1033 Exchange replacement period ends two years after the close of the first tax year. For business or investment real property the replacement period ends three years after close of the first tax year. Three years does not apply to property sold through destruction or theft.

1031 Exchange replacement period ends 180 days after selling of relinquished property.

1033 Exchange seller can complete the exchange by making improvement in property already owned.

1031 exchange seller is required to purchase a new property.

To get detailed 1031 exchange information, it would be worthwhile to know its five types, as given below:

Simultaneous 1031 Exchange

Delayed 1031 Exchange

Improvement 1031 Exchange

Personal property 1031 Exchange

Reverse 1031 Exchange :

In a unique case of 1031 exchanges, the involved people or businesses buy replacement property before they relinquish the initial property. This particular instance in the United StatesInternal Revenue Code is termed as reverse exchange. There may be varied reasons for the exchangers to opt for this method. These may include:

- The desire of the exchanger to buy the replacement property, despite his inability to search for a customer for old property

- The need for improvements in the replacement property

- Inability to close the deal on replacement property, resulting in the apprehensions of loss of money deposits

Summary: Awareness of 1031 exchanges is important if you are looking forward to perform a property transaction. Proper knowledge five different types of 1031 exchanges in this regard are therefore worthwhile, perhaps profitable.

1031 Exchange Example

Example: If an investor is selling a triple net shopping center for $1,000,000, and has a net adjusted basis of $500,000, the investor will have a gain of $500,000 upon the sale of the property.

Current federal capital gains tax is 15% on the amount the property has appreciated in value. The investor will also pay a tax known as depreciation recapture at the rate of 25% for the amount the property has been depreciated during its ownership. In addition, there may be a state or local capital gains tax.

Many investors multiply the gain by 25% to get a rough estimate as to the amount of tax they might realize if they do not structure the transaction as an exchange. In this example the gain would be approximately $500,000. Accordingly, if we multiply this amount by 25% the estimated capital gains tax if this sale were not structured as an exchange would be $125,000.

Three methods for Delayed 1031 Exchange :

1) Identify three properties of unlimited value (Most Common Method)

2) Identify an unlimited number of properties whose aggregate fair market values do not exceed 200% of the value of the properties sold in the exchange

3) Identifies more than three properties and their aggregate fair market value is in excess of 200%, the Exchanger must purchase at least 95% of the value of the properties identified.

1031 Exchange Restrictions:

1) Exchanger has 45 days from the date of the sale of the first relinquished property to identify potential replacement property or properties; and a total of 180 days from the original sale date to purchase the replacement property or properties.

2) Exchanger must acquire replacement property of equal or greater value, obtain equal or greater debt on the replacement property, reinvest all the net proceeds realized from the sale of the relinquished property, and acquire only like-kind property.

3) Exchanger must own the investment property for at least one year before he can use it for 1031 Exchange.

4) Exchanger must initiate the 1031 process before the closing, once the closing occurs; it’s too late to utilize the 1031 deferred exchange.

5) Exchanger may use the vacation house or primary residence for 1031 exchange as long as the property is reported as a rental or business use on the tax returns for two consecutive years.

Advantage of 1031 Exchange :

1) When selling real estate, if you sell and reinvest, you will pay income taxes on the realized gain. However, with 1031 exchange, you will defer the tax gains.

2) You may have management-intense rental properties and would prefer to transfer your equity to ease-of-ownership single tenant properties (coupon clippers) such as Walgreen Drug Stores, Walmart, Post Offices, 7- Eleven, Office Depot, etc.

3) You may have been holding properties long after their appreciation has topped out. You can start rebuilding your equity by disposing of those investments and acquiring new ones.

4) You may have some non-income producing real estate investments, such as raw land. You could exchange this property for another asset that would not only give you cash flow, but also get youincome tax deductions such as depreciation, which you did not have with your raw land.

5) This means that more money is available for acquiring your next investment. It can be regarded as a free loan from the government!

6) You may have owned a leveraged property long enough to have accumulated considerable equity. You now have an opportunity toexchange into a larger asset, and reposition your equity to your benefit or that of your heirs, without paying taxes. We highly recommend using qualified professionals that have experience in 1031 tax-deferred exchanges to guide you and ensure your compliance with government regulations.

7) With proper estate planning you can keep exchanging properties throughout your lifetime. Neither you nor your heirs will ever pay income taxes on the gains. By doing a tax-deferred exchange,you conserve your equity by not having to pay taxes on your net profits.

Disadvantage of 1031 Exchange :

1) Exchanger will have aslightly lower depreciation schedule when acquire new properties. This is because the IRS will look at the new tax basis as being the same as the previous one, less the deferred gain.

2) Exchanger losses on the income tax returncannot be deducted if you exchange property rather than sell it. If you want to take a loss, simply call it a sale, not an exchange.

Calculate Capital Gains Taxes

| Sales Proceeds

| |||

|---|---|---|---|

| 1 | Total Sales Price (Including Debt): | $ | |

| 2 | Total Sales Cost: | $ | Includes selling commissions, costs of inspections, escrow, etc. |

| 3 | Total Sales Proceeds w/Debt: | $-0.00 | Subtract Line 2 from Line 1. |

| Basis | |||

| 4 | Original Purchase Price: | $ | If property was inherited, use value of step up in basis for Line 4. |

| 5 | Depreciation Utilized: | $ | Any depreciation used to shelter cash flow during your hold period? |

| 6 | Purchase Price Basis: | $-0.00 | Add Lines 4 and 5 together. |

| 7 | Capital Improvements: | $ | Include funds used towards capital improvements of your investment. |

| 8 | Total Estimated Basis: | $-0.00 | Add Lines 6 and 7 together. |

| Capital Gains | |||

| 9 | Total Sales Proceeds w/Debt: | $-0.00 | Copy total from Line 3. |

| 10 | Total Estimated Basis: | $-0.00 | Copy total from Line 8. |

| 11 | Total Estimated Capital Gains: | $-0.00 | Subtract Line 10 from Line 9. |

| Estimated Capital Gains Taxes

| |||

| 12 | Total Estimated Capital Gains: | $-0.00 | Copy total from Line 11. |

| 13 | Federal Capital Gains Tax Rate: | 15% | Federal Long-Term Capital Gains Tax is currently 15%. |

| 14 | Federal Capital Gains Taxes: | $-0.00 | Multiply Lines 12 and 13. |

| 15 | Total Estimated Capital Gains: | $0.00 | Copy total from Line 11. |

| 16 | State Income Tax on Capital Gains: | 0.00% |

| 17 | State Capital Gains Income Tax: | $-0.00 | Multiply Lines 15 and 16. |

| 18 | Federal Capital Gains Taxes: | $-0.00 | Copy total from Line 14. |

| 19 | State Capital Gains Income Tax: | $-0.00 | Copy total from Line 17. |

| 20 | Total Estimated Capital Gains Tax: | $-0.00 | Add Lines 18 and 19. |

| Estimated After-Tax Equity

| |||

|---|---|---|---|

| 21 | Total Sales Proceeds w/Debt: | $-0.00 | Copy total from Line 3. |

| 22 | Debt on Relinquished Investment: | $ | Include total debt/liabilities on relinquished investment. |

| 23 | Gross Equity Proceeds from Sale: | $-0.00 | Subtract Line 22 from Line 21. |

| 24 | Gross Equity Proceeds from Sale: | $-0.00 | Copy total from Line 23. |

| 25 | Total Estimated Capital Gains Tax: | $-0.00 | Copy total from Line 20. |

| 26 | Net Equity Proceeds From Sale: | $-0.00 | Subtract Line 25 from Line 24. |

Calculate the taxes on investment property sales using this calculator, provided by 1031InvestmentOpportunity.com In many cases, if you have tax exposure on the sale of your asset, you may have other offsetting losses or options to reduce or eliminate your tax exposure altogether. If you require the assistance of a CPA who specializes in real estate tax, we will be happy to refer you to one.

At Triple Net Investment Group we can assist you in locating a like-kind property for a 1031 exchange and ensure a smooth and successful transaction.